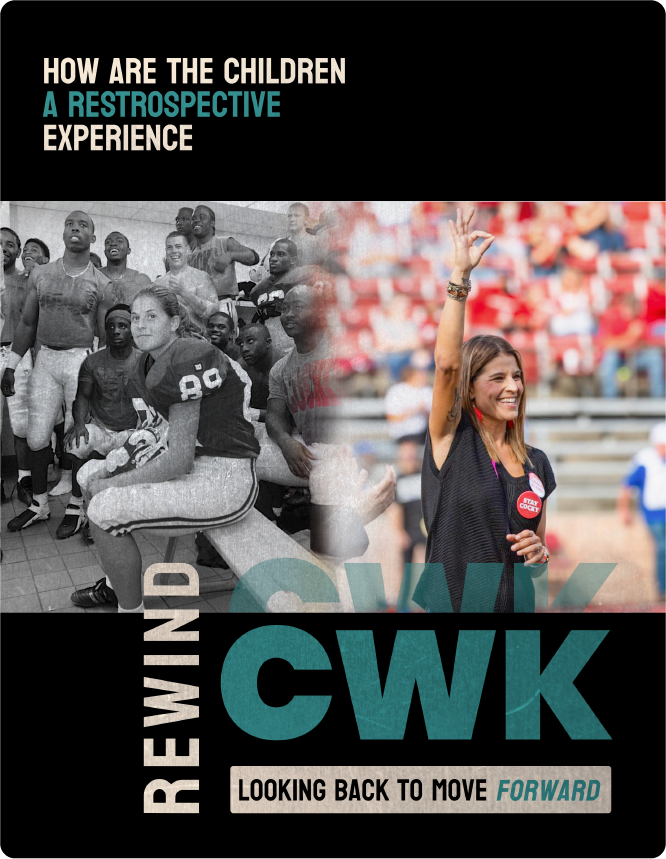

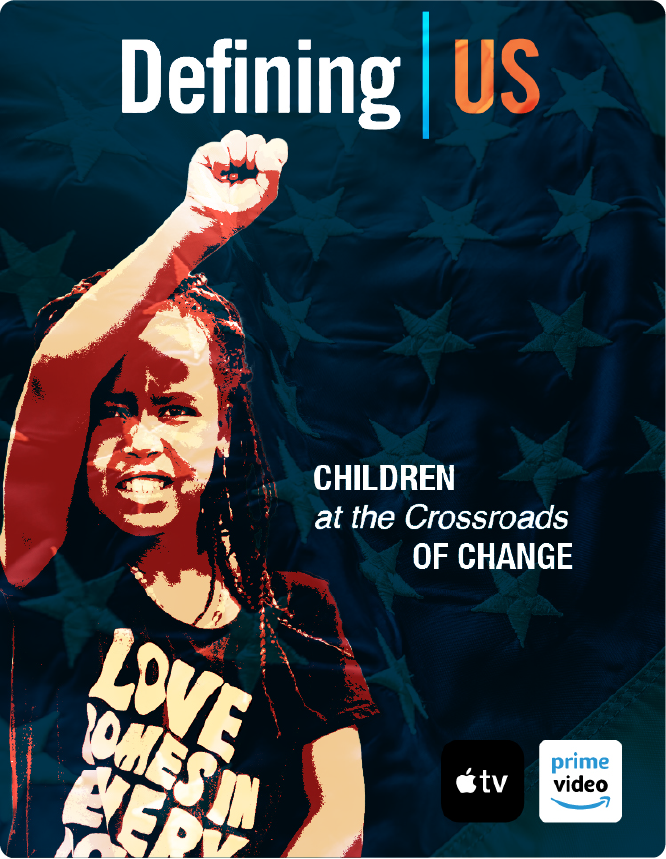

At CWK, entertainment meets purpose and impact. Our captivating, amusing, and stirring unscripted programs also include storylines that challenge narratives, restore human dignity, reframe pressing social issues, and unveil unexpected champions who leave audiences cheering and wanting more. Our film archive includes thousands of original stories offering a unique, cultural depth perception of the human experience from the turn of the century until now.

Beyond television, our elevated engagement platform offers lifelong learning for home, school, work, and community markets. With a legacy spanning over two decades, CWK has earned dozens of top TV awards and educational designations.

Social Platforms

PARTNERS